At the beginning of April, the 1st of April, I was asked to speak at Lloyds of London.

Now those of you that know me well will imeadiatley think ‘are they crazy? Going to let John speak on April Fools day?’

I understand the concerns but despite my instinct to present a world in which the FCA were behaving in a sensible, non contradicting way as a joke, I realised that people attending would be earning CPD points and so there had to be some real content.

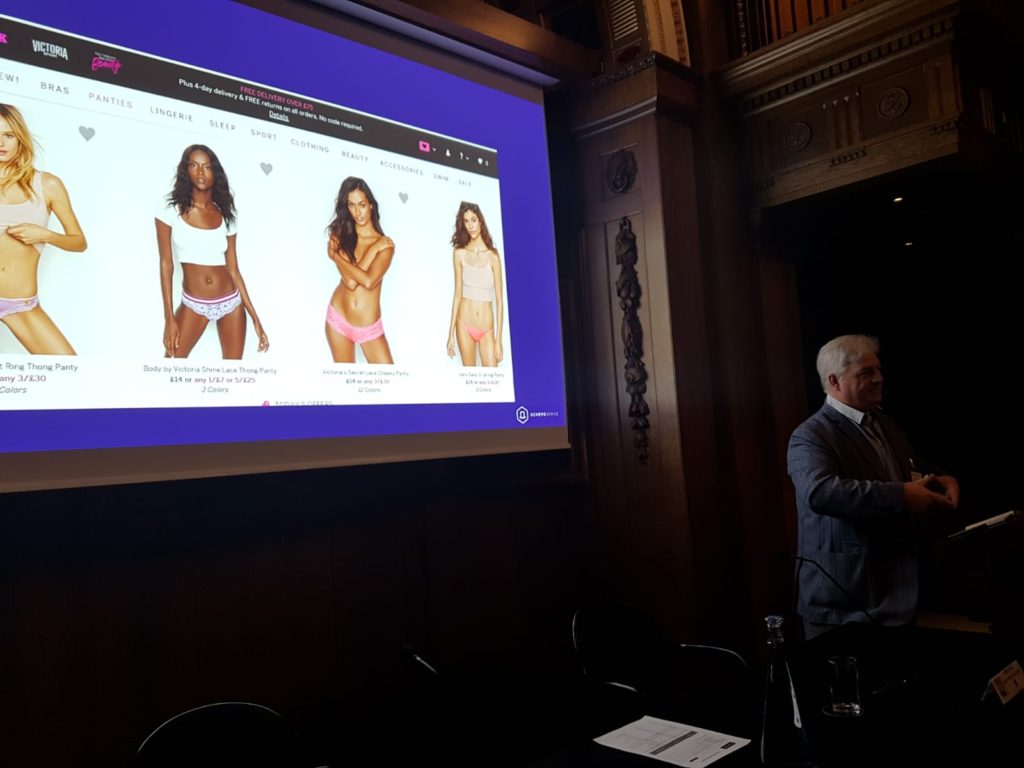

I recalled some comments I had heard months before about insurance being a commodity and therefore the only was to sell on price. Rubbish. I did an entire presentation revolving around ladies pants.

It’s possible to buy ladies pants at 4 pairs for a tenner at Marks and Spencer, £25 each at Victoria Secrets and £250 a pair at Versace – and I illustrated with pictures of there websites.

All the ‘insurance people’ around me said I couldn’t do this, show ladies pants in the revered wooden panelled library at Lloyds. I didn’t listen.

The talk resulted in more feedback and follow up than had – according to my host – had ever happened from a talk there (and theres been 1 a month for more than 10 years). It was all extremely positive – we will make sales from it, people are still referring to the ‘pants’ talk when they call us.

I even had the professional standards director of the CII (the body that regulates conduct in our profession) ask if she could borrow the slides.

Moral of this story is, do what you believe in – ignore all people around who say you cant. Cant just means its not been done yet.

Don’t think I’m right, come on down…